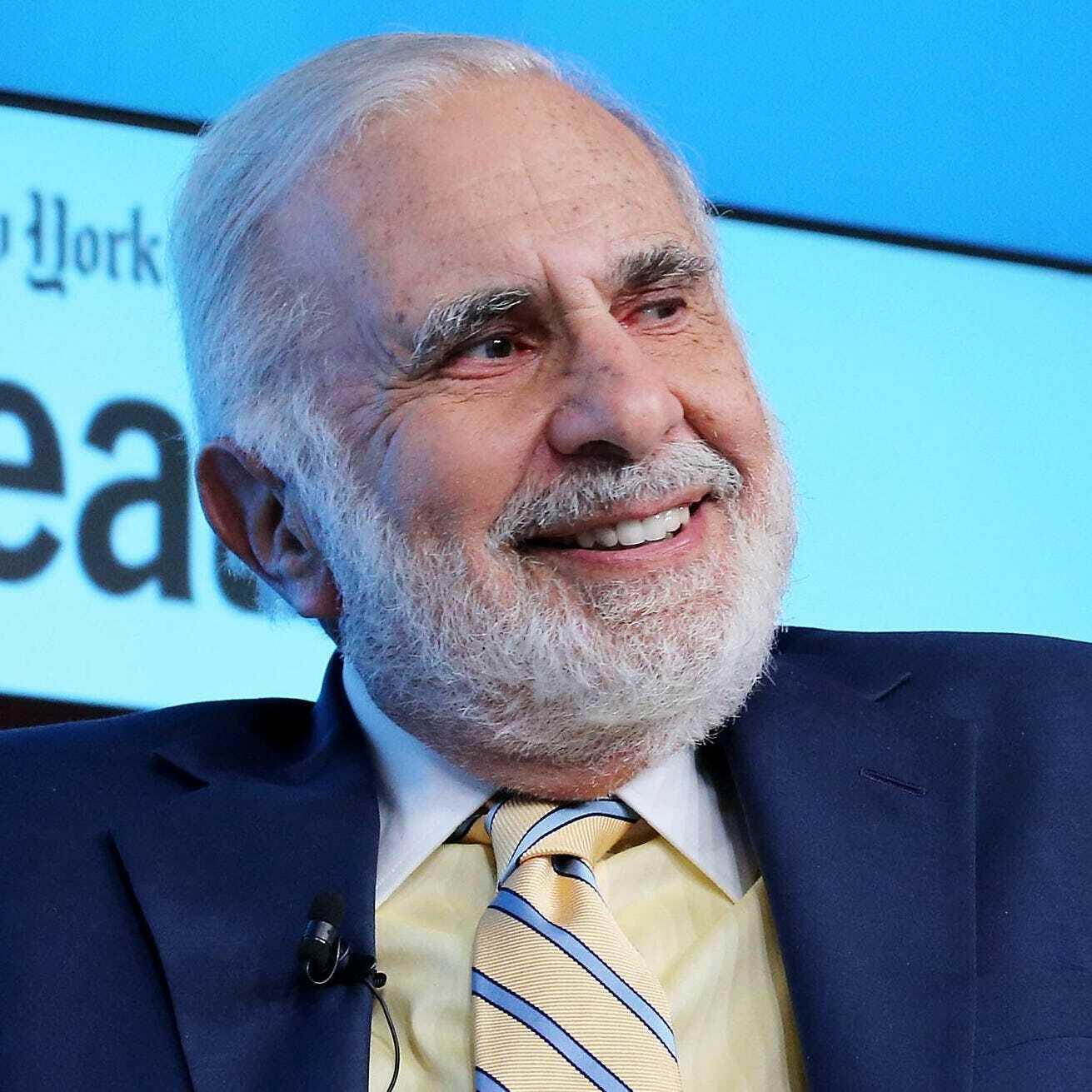

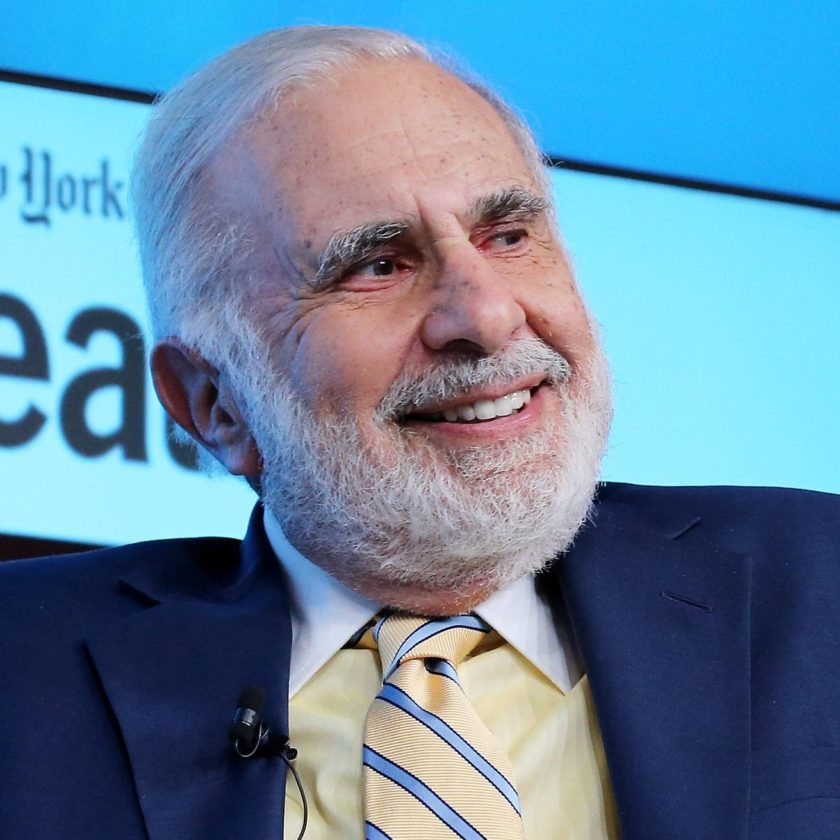

Billionaire Carl Icahn Predicts a Recession or Worse. Read Full Article.

He says ‘There’s No Accountability in Corporate America‘.

Millionaire Carl Icahn, the founder of Icahn Enterprises, has predicted that the U.S. economy could be headed towards “a recession, or the worst.” The well-known investor has warned of “a lots of problems in the coming months” in addition to “a bumpy ride.”

Billionaire Carl Icahn Predicts a Recession in the U.S.

The famous billionaire investor and investor Carl Icahn said Tuesday in an interview with CNBC that an economic recession or even something more severe is possible to the U.S. economy.

Icahn is the co-founder of Icahn Enterprises, a publicly-traded company and conglomerate holding company that is diversified and located within New York City.

His net worth at present is around $17 billion.

Indicating that rising inflation poses a danger to the economy, he stated:

I believe there may be a recession, or even more severe.

From his experiences of serving as a board member of many businesses, “when you get to know what boards are doing, it becomes apparent that the system needs to be fixed.

” Additionally, he said that “we have supply chain issues” in the present because “our companies are so poorly managed.”

Icahn expressed the following opinion:

There is no accountability in corporate America.

There are some excellent businesses with extremely good CEOs.

Still, far too many aren’t capable of completing the job, which I believe will require.

He then shared his investing strategies.

“I have kept everything in a hedge in the last couple of years, and now that we have it, we have a solid hedge against the long-term positions we want to take on and gain the edge.

This is how I view it. But I’m not as positive as you can see. Short term, I don’t even predict,” he detailed.

It was then asked if the Icahn Enterprises founder was then asked if he thinks there’s a chance for a soft landing.

“I am not sure if they (the Fed could make a smooth landing but … I believe we’re in lots of challenges in the coming days … In my view, I believe it will take a hard landing” said he, adding:

Inflation isn’t a good thing when it is in the process of gaining momentum.

It isn’t possible to get the bottle back very easily. We witnessed this in the 1970s, and we witnessed what transpired.

“In the past twenty or thirty years … you could get low-cost goods coming from China, from the Far East, from China certainly even in Russia …

The thing is, I think that the days of cheap goods are gone.

You’re dealing with the war between Russia and Ukraine currently in progress, which adds problem to your picture of inflation,” the billionaire noted.

Follow us or bookmark us for more Bollywood news box office collection report celebrities trailers and promos

Join us on Facebook :

Join us on Twitter :