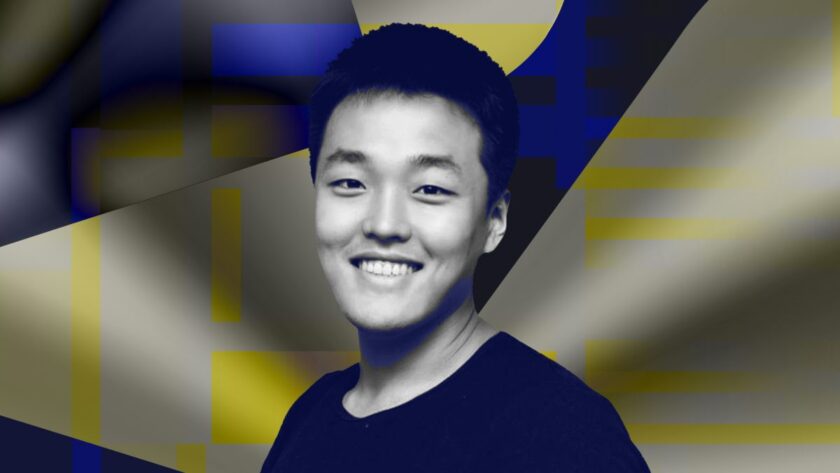

Attorneys representing Terraform Labs and its co-founder Do Kwon argue that a fine closer to $1 million is more appropriate than the $5.3 billion proposed by the U.S. Securities and Exchange Commission (SEC) after the parties were found guilty of fraud.

Their request comes following the SEC’s assertion that Kwon and Terraform should pay approximately $4.7 billion in disgorgement and prejudgment interest, with Terraform and Kwon facing $420 million and $100 million, respectively, in civil penalties.

In a court filing posted late last week, Kwon and Terraform’s legal team argued for a significantly lower figure. “In conclusion, the Court should not grant any injunctive relief or disgorgement, and should impose at most a $1 million civil penalty against TFL,” they stated.

The SEC’s charges against Terraform and Kwon, filed in February 2023, stem from the collapse of the algorithmic stablecoin Terra USD (UST) in May 2022. Algorithmic stablecoins like UST use market incentives through algorithms to maintain a stable price, with Terra linked to luna, a governance token, for price stability. The crash of UST resulted in the loss of over $50 billion.

A jury recently found both Terraform and Kwon guilty of misleading investors and civil fraud. The case primarily focused on allegations by the SEC that Kwon and Terraform violated federal securities laws by committing fraud related to the buying and selling of Terraform securities. Judge Jed Rakoff had previously ruled in favor of the SEC in its claim that Terraform and Kwon offered and sold unregistered securities.

Following the verdict, a Terraform spokesperson stated, “We are carefully weighing our options and next steps.”

Also Read, Former Openbazaar Lead Developer Exposes Hidden Truths Behind Bitcoin’s Lightning Network

Williams-Sonoma Fined $3.2 Million for Violating ‘Made in USA’ Labeling Order

Bookmark and Follow us for More Business News