Compound: The Protocol Behind DeFi Lending and Borrowing

In the world of decentralized finance (DeFi), lending and borrowing have emerged as crucial financial activities. DeFi platforms provide individuals with the opportunity to lend their digital assets and earn interest, or borrow assets by providing collateral.

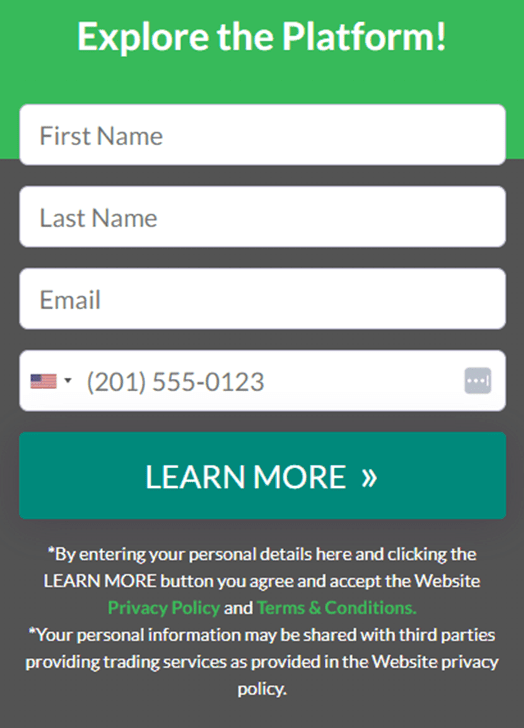

One of the most prominent protocols facilitating these activities is Compound, which has revolutionized the lending and borrowing landscape within the blockchain ecosystem. In this article, we will delve into the workings of Compound and explore how it has revolutionized the lending and borrowing landscape within the blockchain ecosystem. For more info click on the image link.

Understanding Compound

What is Compound?

Compound is an open-source lending protocol built on the Ethereum blockchain. It enables users to supply and borrow a variety of cryptocurrencies without intermediaries. The protocol operates on smart contracts that automatically execute lending and borrowing transactions based on predefined parameters and market dynamics.

How Does Compound Work?

Compound operates through pools of assets, with each asset having its pool. These pools are collectively known as “money markets.” When users supply their assets to a money market, they receive cTokens in return. cTokens represent the user’s share in the pool and accrue interest over time. The interest earned by the lenders is collectively distributed among the suppliers based on their proportionate share of the pool.

On the other hand, borrowers can provide collateral and borrow assets from Compound’s money markets. The borrowing process involves locking up collateral over the borrowed amount. This collateral acts as insurance, ensuring that lenders are protected against defaults. The interest rates for borrowing are determined algorithmically based on the supply and demand dynamics within each money market.

Advantages of Compound

The compound offers several advantages that have contributed to its popularity within the DeFi space:

Accessibility

Compound allows anyone with an internet connection and compatible digital assets to participate in lending and borrowing activities. This inclusivity has empowered individuals who were previously excluded from traditional financial systems.

Decentralization

By operating on the Ethereum blockchain, Compound eliminates the need for intermediaries, such as banks or credit institutions. The protocol leverages the trustless nature of blockchain technology, ensuring transparent and secure transactions without relying on centralized entities.

Efficiency

Compound’s algorithmic interest rate adjustments enable efficient allocation of capital. The interest rates are determined based on the supply and demand dynamics within each money market, ensuring a fair and market-driven pricing mechanism.

Flexibility

The protocol supports a wide range of assets, allowing users to lend and borrow various cryptocurrencies. This flexibility provides users with options to diversify their portfolios and take advantage of different market opportunities.

Risks and Considerations

While Compound offers numerous benefits, it is important to be aware of the risks associated with engaging in DeFi lending and borrowing activities:

Smart Contract Risks

Compound operates through smart contracts, which are susceptible to vulnerabilities and bugs. Although the protocol undergoes extensive audits, unforeseen vulnerabilities may still arise, potentially resulting in financial losses.

Market Volatility

The cryptocurrency market is known for its volatility, which can impact the value of both supplied and borrowed assets. Sudden price fluctuations can lead to liquidations or impermanent losses, affecting the overall profitability of users.

Counterparty Risks

While Compound eliminates the need for intermediaries, it does not eliminate counterparty risks. The protocol relies on borrowers providing sufficient collateral, and there is always a chance of defaults or insufficient collateralization.

Users need to understand these risks and conduct thorough research before engaging in lending and borrowing activities on Compound or any other DeFi platform.

Conclusion

The compound has emerged as a prominent protocol within the DeFi space, revolutionizing the lending and borrowing landscape. Its decentralized and efficient approach enables users to participate in the world of digital finance, regardless of their geographical location or financial status. By leveraging blockchain technology, Compound has provided a transparent, secure, and accessible platform for individuals to lend and borrow cryptocurrencies.

As the DeFi ecosystem continues to evolve, Compound’s contributions are likely to have a lasting impact. With its advantages of accessibility, decentralization, efficiency, and flexibility, Compound has positioned itself as a frontrunner in the realm of decentralized lending and borrowing protocols. However, users must be aware of the associated risks and exercise caution while participating in these activities.