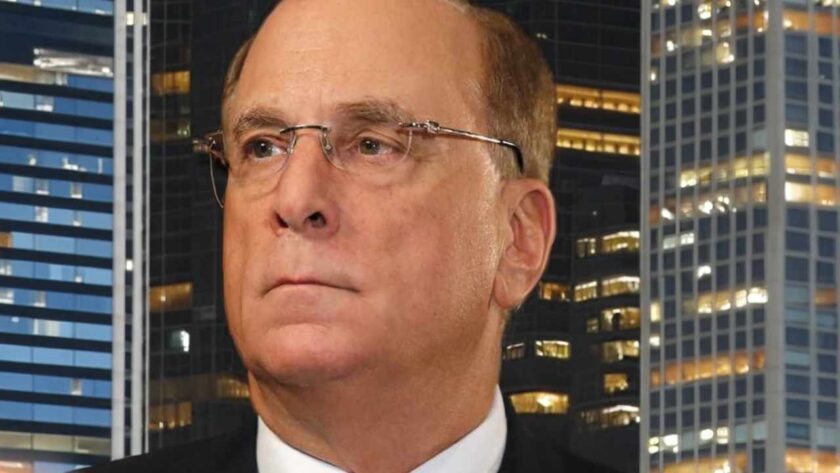

Blackrock CEO, Larry Fink, Warns of US Jeopardizing Dollar’s Reserve Currency Status

Blackrock CEO, Larry Fink, Warns of US Jeopardizing Dollar’s Reserve Currency Status, Blackrock CEO Raises Concerns Over US Risking Reserve Currency Status of the Dollar

Larry Fink’s Insights on Inflation and Future Rate Hikes

During a financial services conference, Larry Fink, CEO of Blackrock, the world’s largest asset manager, shared his perspective on the U.S. economy, the potential for future interest rate increases, and the U.S. dollar’s reserve currency status. Fink expressed his belief that the Federal Reserve will raise interest rates at least twice more, highlighting concerns about persistent inflation.

Fink stressed the need for the Fed to remain vigilant, asserting that inflation remains strong and resistant to decline. While acknowledging the resilience of the economy, he pointed out specific areas of concern, such as the commercial real estate sector. Federal Reserve Chair Jerome Powell recently hinted at a possible pause in interest rate hikes for the current month.

Despite the challenges, Fink expressed confidence that the U.S. is not headed towards a severe economic downturn, suggesting that any potential recession would likely be modest in scale.

Concerns Surrounding the U.S. Dollar’s Reserve Currency Status

The CEO of Blackrock expressed worry over the impact of the debt ceiling debate on the U.S. dollar’s position as the global reserve currency. He emphasized that the ongoing “drama” surrounding the debt ceiling has eroded trust in the dollar. The risks of potential default, credit rating downgrades, and the consequent destabilization were cited as factors jeopardizing the dollar’s reserve currency status.

The erosion of trust in the U.S. dollar was seen as a pressing issue that needs to be addressed and rebuilt in the long run. Notably, credit rating agencies such as Fitch Ratings and Moody’s have expressed concerns over the U.S. credit rating, citing policy mistakes and the risk of confidence loss as potential threats to the dollar’s position.

To avert a possible default, President Joe Biden signed a bill suspending the debt ceiling, temporarily avoiding a major crisis. However, the underlying risks to the U.S. dollar’s reserve currency status remain significant, necessitating attention and resolution in order to restore trust and stability.

Also Check: Be Careful Of Bitcoin/BTC Trading WhatsApp Groups Scam

Follow us or bookmark us for more Business Technology Entertainment News Celeb Bio box office collection report celebrities trailers and promos

Join us on Facebook

Join us on Twitter