Bitcoin Whale Moves 200 BTC from 2013, Revealing a 197,785% Increase in Value

On June 3, a bitcoin holder moved 200 BTC worth $13.87 million after these funds had remained untouched for over 11 years. If sold today, the value of these bitcoins has increased by 197,785% since their acquisition.

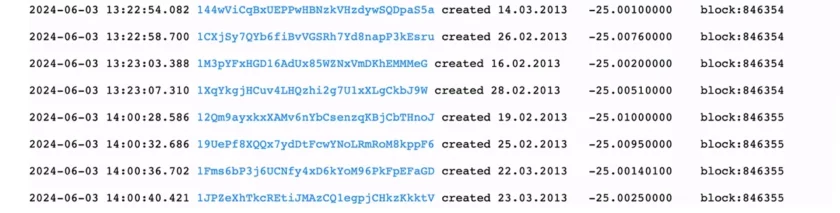

Spending 200 Bitcoin Unveils Previous Transactions From 2013

On Monday, a bitcoin (BTC) holder who acquired funds in early 2013 spent 200 BTC worth $13.87 million based on the June 3, 2024, exchange rates. The bitcoins were obtained between mid-February and late March 2013, when BTC traded between $25 and $35 per coin. This means the funds were initially valued at around $7,000 at the highest BTC prices during that period.

With a current value of $13.87 million, the owner has seen the coins appreciate by 197,785% against the U.S. dollar. All eight addresses were legacy-style Pay-to-Pubkey-Hash (P2PKH) wallets, and the funds were transferred to two distinct Pay-to-Script-Hash (P2SH) wallets. Each wallet sent slightly over 25 BTC worth $1.7 million at current exchange rates.

At the time of writing, the funds remain in these wallets, and the new wallets’ data show previous activity consolidating dormant bitcoin transactions in March and January 2024. Data from btcparser.com and one address indicate that this same entity is likely responsible for eight distinct 2013 transactions that occurred on March 13, 2024. That’s because those too were present in the forwarding wallet.

On that day, the transactions each involved transfers of 25 BTC just like the latest spend. Another wallet showed a different pattern with one transaction adding 199.99 BTC when it was created on Jan. 10, 2024, and the funds were sent out the next day. On Feb. 11, 2024, the user acquired another 199.99 BTC and then transferred it out three days later, on Feb. 14, 2024.

Additionally, the same entity followed this identical pattern on March 1, 2024, initiating eight transfers of slightly more than 25 BTC each. This transaction also involved moving 200 bitcoins from 2013, marking their first activity in over ten years.

These patterns and past transactions highlight that the 200 BTC moved on June 3 indicates the owner possesses more vintage coins from the early days. From the activity in just two wallets, it is evident that the entity had or still controls 1,000 BTC worth $69.2 million, most of which originated from BTC collected in 2013.

This places the entity in the ‘whale’ category for owning 1,000 BTC or more. A brief onchain analysis, along with repeated spending patterns and heuristics, has revealed a much larger holder than the eight spends on Monday initially indicated.

Source: Bitcoin.com News

Also Read, Pantera Capital’s Liquid Token Fund Soars 66% in Q1 2024, Diversifies Beyond Bitcoin and Ethereum

Tether Expands Bitcoin Holdings with $600 Million Acquisition, Amplifying Its Market Influence

UK Court Freezes £6 Million in Assets of Craig Wright Over Bitcoin Creator Claim Dispute