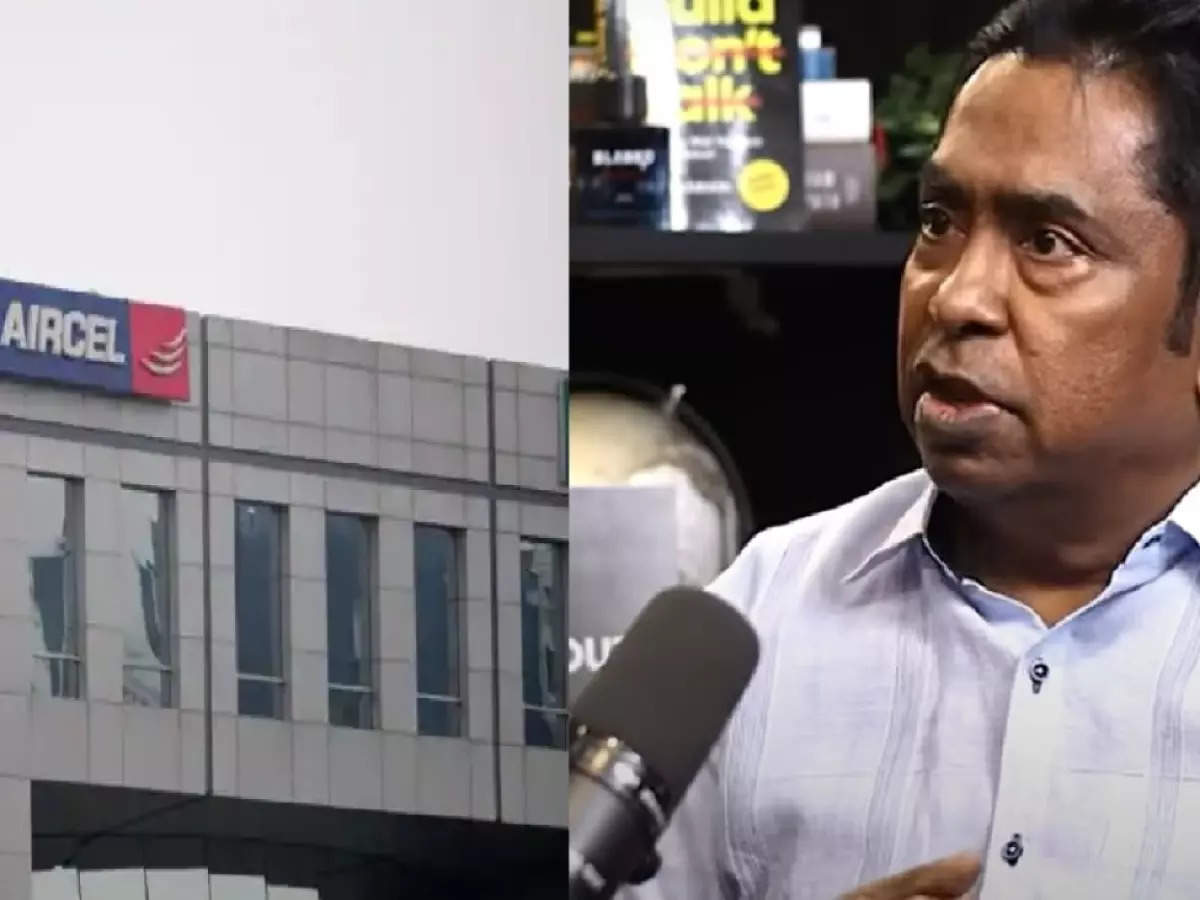

Chinnakannan Sivasankaran, the founder of Aircel, reflected on the changing landscape of Indian business during a podcast hosted by Raj Shamani. He remarked that today’s India is vastly different from a decade ago when businesses faced immense pressures, often leading to tough choices.

“Politicians intervened and I lost my company,” Sivasankaran lamented.

Aircel’s journey in India was marked by challenges such as intense competition and regulatory obstacles, eventually leading to its exit from the market in February 2018 due to financial issues. In 2006, Maxis Berhad, led by Ananda Krishnan, a Malaysian of Sri Lankan Tamil descent, acquired a 74% stake in Aircel. The Aircel-Maxis deal came under scrutiny in 2011 when Sivasankaran alleged he was coerced into selling his stake to Maxis.

“I only received a paltry sum of Rs 3,400 crore from the deal. If I had sold it to AT&T, I would have received 8 billion (sic),” Sivasankaran remarked. When asked about the compulsion at the time, he highlighted the difference in India’s business environment then and now. “Today, no one can pressure you,” he noted, contrasting the past when entrepreneurs often faced pressure to sell to specific individuals.

Sivasankaran criticized Krishnan for mismanaging Aircel, resulting in significant losses of around $45 billion and affecting numerous lenders. He emphasized the importance of a liberalized India where entrepreneurs can build businesses without external pressures. “My complaint is not that they forced me to sell, my complaint is they should have allowed me to sell to the one who offered me 8 billion,” he added.

Sivasankaran’s entrepreneurial journey began in 1985 when he purchased Sterling Computers from Robert Amritraj, father of tennis star Vijay Amritraj, and introduced affordable PCs priced at just Rs 33,000, compared to competitors’ machines costing up to Rs 80,000. This move propelled Sterling to become one of the top three computer companies in India. He reportedly attempted to acquire over 10 percent of Sunil Mittal’s Bharti Telecom by 1997 but was denied a board seat, leading him to sell his shares to Mittal at a loss. He also famously offered to buy Enron India’s troubled energy business for one rupee.

Also Read, Adani Group Reaches $200 Billion Market Cap Amid Allegations

Apple Appeals $2 Billion EU Antitrust Fine Over App Store Restrictions