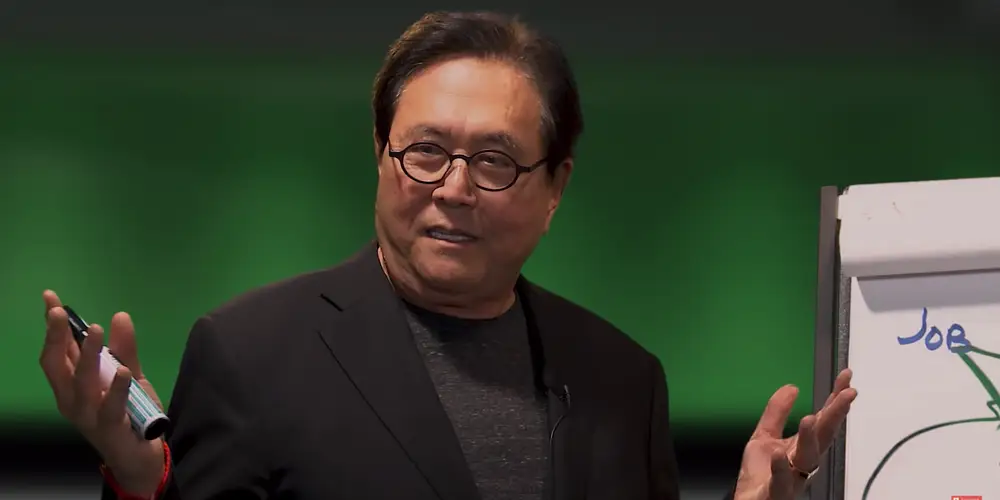

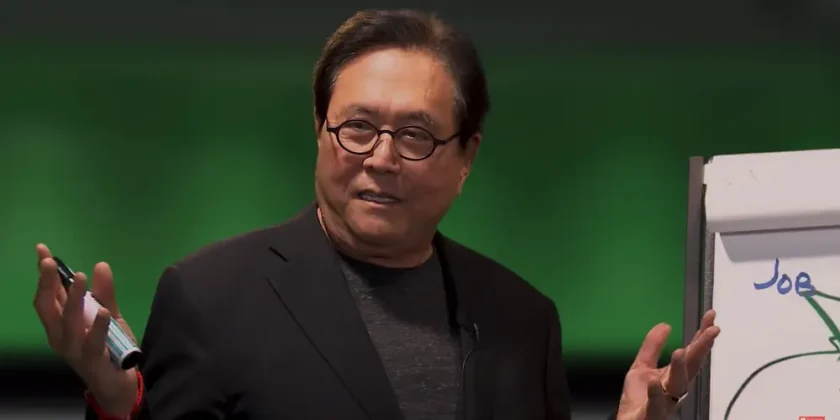

Robert Kiyosaki, author of “Rich Dad Poor Dad,” supports Ark Invest CEO Cathie Wood’s prediction that Bitcoin might soar to $2.3 million. Amidst his concerns about potential market crashes and U.S. bankruptcy, Kiyosaki emphasizes the strategic value of investing in Bitcoin as a financial safeguard.

Robert Kiyosaki, author of the bestselling book “Rich Dad Poor Dad,” recently expressed his confidence that bitcoin could reach a staggering $2.3 million per unit. His assertion is based on a prediction from Ark Invest CEO Cathie Wood. At the same time, Kiyosaki has predicted a downturn for the stock, bond, and real estate markets, even suggesting that the U.S. could face bankruptcy.

In his latest social media post on platform X, Kiyosaki cited Cathie Wood’s forecast that bitcoin might eventually hit $2.3 million. “Do I believe her? Yes I do,” he stated, acknowledging Wood’s intelligence and his trust in her judgement.

“Could she be wrong? Yes. She could be. So what? The more important question is ‘What do you believe?’ … And most importantly: ‘How many bitcoin do you own?’” Kiyosaki posed to his followers, stressing the importance of owning bitcoin if Wood’s prediction turns out to be correct. He further shared his personal view: “I too believe bitcoin will reach $2.3 million.”

He also encouraged taking risks with bitcoin investments, even if small: “I suggest ‘Live dangerously.’ If you can afford $.01 bitcoin… you will be better educated, smarter, wiser when it comes to bitcoin,” he advised.

Cathie Wood’s firm, Ark Invest, holds an even more optimistic outlook, placing their bullish scenario for bitcoin at $1.5 million. She elaborated that with just over 5% allocation from institutional investors to bitcoin, it could boost their projection to the $2.3 million mark initially suggested.

Wood also pointed out that the rising interest in spot bitcoin exchange-traded funds (ETFs) and other dynamics are propelling bitcoin’s value. She views the cryptocurrency as a safeguard against poor economic policies and currency devaluation. “I think this is an insurance policy against rogue regimes or against just horrible fiscal and monetary policies,” she explained, noting the role of bitcoin as a “flight to safety” in current financial climates.

Also Read, U.S. Banks Brace for Modest Profit Declines Amid Interest Rate Adjustments

Elon Musk Slips Below Mark Zuckerberg in Billionaire Rankings Amid Tesla’s Stock Decline

Bookmark and Follow us for More Business News