In a significant economic development, the US added 303,000 jobs in March, exceeding economist predictions and previous months’ growth. This uptick suggests a delay in anticipated interest rate cuts, amidst ongoing adjustments in Wall Street’s economic forecasts.

In March, the US economy saw an impressive addition of 303,000 jobs, surpassing economists’ predictions of 200,000 and outdoing the 270,000 jobs added in February. This surge suggests that the anticipated reduction in the historically high interest rates of 5.25 to 5.5 percent might not be imminent.

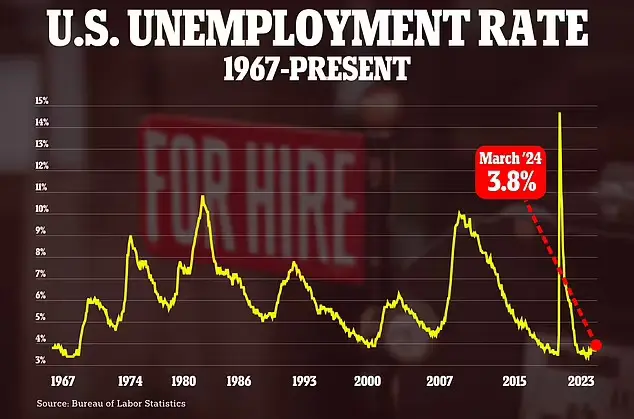

The unemployment rate experienced a slight decrease, falling by 0.1 percent to 3.8 percent, as reported in the government’s employment report for March. Notable job increases were seen in sectors such as healthcare, government, and construction, while manufacturing jobs remained steady following a revision that showed a loss of 10,000 jobs in the previous month.

This substantial rise in employment led Wall Street to adjust its expectations for an interest rate cut, also lowering the predicted probability of three rate cuts this year from 97 percent to 92 percent.

Bret Kenwell, a US Investment Analyst at eToro, mentioned, “This report may do little to ease investors’ concern about the Fed further delaying rate cuts.” The monthly employment figures from the US Bureau of Labor Statistics are keenly observed by Wall Street, which balances the desire for low unemployment with concerns over excessive job creation potentially fueling inflation.

The Federal Reserve’s decisions on interest rates are influenced by inflation trends. Should inflation remain high, the Fed may postpone rate cuts, affecting the stock market due to higher borrowing costs for large corporations and reduced consumer spending, ultimately impacting stock prices and 401(K)s.

Despite the robust job report, stock markets, including the S&P 500 and Nasdaq, experienced slight increases of 0.5 and 0.7 percent respectively, more than an hour post-release. According to David Waddell, CEO and chief investment strategist at Waddell & Associates, the market absorbed the news of the job additions well because of a slight decrease in wage growth.

Year-over-year, hourly earnings rose by 4.1 percent, a decline from the 4.3 percent increase the previous month, marking the lowest wage growth rate since June 2021. Waddell highlighted, “The meaningful data point… is average hourly earnings… So the employment report was hot, but it was a cooling inflation report and that’s why the market can digest it… this doesn’t really change anything.”

The Federal Reserve targets a 2 percent inflation rate, which typically aligns with a 3 to 3.5 percent wage growth rate.

Also Read, FTX Estate Sells $1.9 Billion in SOL Tokens to Reduce Debt

Tesla Faces New Class Action Lawsuit Over Wage Law Violations in California

Bookmark and Follow us for More Business News