Things You Should Know Before Using Net Banking

| Table Of Content |

|---|

| About |

| Benefits of net banking |

| Features-of-Online-Banking |

| Advantages of Internet Banking |

| Disadvantages-of-Internet/Online-Banking |

| Must-Know-Tips-Before-Using-Net-Banking |

About

Gone are the days when banking meant long hours at the bank and queues that never seemed to end. Thanks to technology, even banking has been revolutionised.

Earlier you would have to give yourself enough self-talk about procrastination to visit the bank, fill out lengthy forms and submit them, wait forever for the net-banking kit to arrive, and finally, activate it before you use the facility.

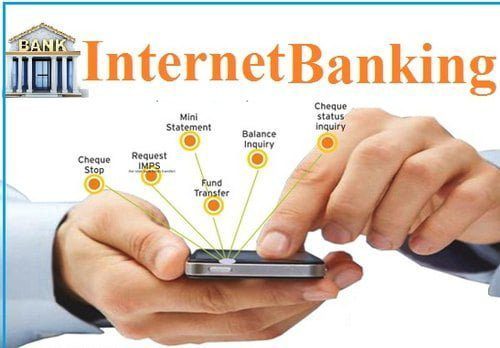

Presently, internet banking has made banking simple for millions of people across the world. Online banking has made it possible for countless customers to carry out simple tasks within a few clicks and minutes.

Most banks have apps that can be downloaded on your phone and used on the go. With online banking, you can access your Savings Account anytime, review your account activity, receive e-statements, keep track of your account balance, pay bills and shop online, and transfer funds anytime and anywhere. Also Read, About Gold Line Company seller of gold and silver coins

Let’s take a look at some of the benefits of net banking:

- Ease of operation: A smartphone with a steady internet connection is all you need for online banking. In many ways, maintaining an online account is free of hassle, unlike traditional banking. In addition, you no longer need to schedule a visit to the bank. With e-banking apps, you can take care of your banking needs on weekends and public holidays.

- Paying Credit Card bills through net banking: When you pay your Credit Card bills through internet banking, you eliminate additional fees such as service or transaction charges.

- Element of security: As net banking gains traction, tighter security measures are implemented. With banks taking steps to curb internet fraud, net banking is emerging as a safe and secure mode of payment.

- Convenient: How convenient can it be to access banking facilities anywhere and anytime? And what’s even better is that there’s no need to drag yourself to the bank anymore. It’s like carrying your bank wherever you go!

- Tracking account activity: Simple and essential tasks such as reviewing your account activity, checking your account balance, and transferring money can be completed with just a few clicks.

- Time saving and efficient: E-banking is fast, efficient, and saves much of your time. Now that you can access your banking requirements remotely, you can finally take up the language class you have been meaning to, cook yourself a great meal, or even cultivate the hobby you have been planning for years.

- Go Cashless: Net banking allows you to carry your bank (figuratively!) wherever you go. So say goodbye to carrying wads of cash. Just carry Credit Cards or Debit Cards linked to your bank accounts. Simple, isn’t it? Also Read, Fox And Verizon New Multi-Year Distribution Deal That Adds Fox Weather And Tubi

However, there are certain pitfalls to watch out for. Let’s take a look at them:

- Acquired habit: With some of us still believers in conventional banking, it will take time for many to acknowledge the perks of e-banking. While you can find net banking demos on most banks’ websites, certain banks do not offer this facility. This might pose a challenge to those new to the banking world.

- Internet access is a must-have: You can’t use net-banking facilities without a stable internet connection. Similarly, net banking will be useless when the bank’s server is down.

- Security of online transactions: This is undoubtedly one of the key factors that deter people from accessing e-banking facilities. Despite arduous encryption processes in place, security breaches have occurred. Though such instances are rare, they are not unheard of.

- Securing your password: Passwords are crucial for online accounts. Make sure never to share your passwords, and keep changing the same to eliminate any chances of account hacking and password theft.

- Customer service with online banking: Years of going to the bank will probably familiarise you with the banking staff. With online banking, you will have to rely on customer support executives to address your queries. However, this should not be too much of a concern with most banks having trained customer service executives.

Here’s good news for State Bank of India (SBI) customers yet to register for net banking! Earlier, registering for Net banking was a tedious process. Times have changed, and you can now register for internet banking without going to the bank. All you need to do is register online.

However, certain conditions are involved. To register for net banking online, you must ensure you haven’t already availed of the service through the branch. Your contact number must be registered with the bank, and you must have an operational ATM card.

Joint bank-account holders cannot register online. They have to visit the bank branch to avail of net-banking services.

Net banking is a gateway to complete control over your finances! With money management now made more accessible than ever, don’t miss out on the perks of online banking. It’s time to take the plunge and let net banking make your life easy!

Features of Online Banking

- Check the account statement online.

- Open a fixed deposit account.

- Pay utility bills such as water bills and electricity bills.

- Make merchant payments.

- Transfer funds.

- Order for a cheque book.

- Buy general insurance.

- Recharge prepaid mobile/DTH.

Also Read, German insurance company Allianz on Friday posted a 23% fall in second-quarter net profit

Advantages of Internet Banking

The advantages of internet banking are as follows:

- Availability: You can use the banking services round the clock throughout the year. Most of the services offered are not time-restricted; you can check your account balance at any time and transfer funds without waiting for the bank to open.

- Easy to Operate: Using the services offered by online banking is simple and easy. Many find transacting online a lot easier than visiting the branch for the same.

- Convenience: You need not leave your chores behind and stand in a queue at the bank branch. You can complete your transactions from wherever you are. Pay utility bills, recurring deposit account instalments, and others using online banking.

- Time Efficient: You can complete any transaction in a few minutes via internet banking. Funds can be transferred to any account within the country or open a fixed deposit account within no time on net banking.

- Activity Tracking: When you make a transaction at the bank branch, you will receive an acknowledgement receipt. There are possibilities of you losing it. In contrast, all the transactions you perform on a bank’s internet banking portal will be recorded. You can show this as proof of the transaction if need be. Details such as the payee’s name, bank account number, the amount paid, the date and time of payment, and remarks, if any, will be recorded as well.

Also Read, All You Want To Know About FTX NFT Marketplace 2022

Disadvantages of Internet/Online Banking

The disadvantages of internet banking are as follows:

- Internet Requirement: An uninterrupted internet connection is a foremost requirement for internet banking services. If you do not have access to the internet, you cannot make use of any facilities offered online. Similarly, if the bank servers are down due to any technical issues on their part, you cannot access net banking services.

- Transaction Security: No matter how many precautions banks take to provide a secure network, online banking transactions are still susceptible to hackers. Irrespective of the advanced encryption methods used to keep user data safe, there have been cases where the transaction data is compromised. This may cause a significant threat, such as using the data illegally for the hacker’s benefit.

- Difficult for Beginners: There are people in India who have been living far away from the internet web. It might seem new for them to understand how internet banking works. Worse still, if there is nobody who can explain to them how internet banking works and the process flow of how to go about it. It will be difficult for inexperienced beginners to figure it out for themselves.

- Securing Password: Every internet banking account requires a password to be entered to access the services. Therefore, the password plays a crucial role in maintaining integrity. If the password is revealed to others, they may utilise the information to devise some fraud. Also, the chosen password must comply with the rules stated by the banks. Individuals must change the password frequently to avoid password theft which can be a hassle to remember by the account holder himself.

Whether it is bill payments, funds transfers or the creation of a fixed deposit, internet banking allows you to do it in a fast and convenient way. Instead of going to the bank and waiting in an unending queue, internet banking has made all banking functions accessible through a few clicks. However, this facility must be used carefully due to the risk of phishing – fraudulent means of attaining your confidential banking information.

Also Read, United Kingdom Banks cut mortgage offers amid the economic panic

Must Know Tips Before Using Net Banking

- Change your password regularly.

- For the first time you log in to your internet banking account, you will need to use the password provided by the bank. However, it would help if you changed this password to keep your account safe. In addition, keep changing your password at regular intervals. More importantly, keep the password confidential at all times.

- Do not use public computers to log in.

- Avoid logging in to your bank account at common computers in cyber cafes or libraries. These are crowded places, and there are more chances of your password being traced or seen by others. If you have to log in from such places, clear the cache and browsing history and delete all the temporary files from the computer. Also, never allow the browser to remember your ID and password.

- Do not share your details with anyone.

- Your bank will never ask for your confidential information via phone or email. So whether you get an apparent phone call from the bank or an email requesting your details, do not give out your login information. Use your login ID and password only on the official login page of the bank, which should be a secure website. Look for ‘HTTPS://’ in the URL when logging in; the website is secure.

- Keep checking your savings account regularly.

- Check your account after making any transaction online. Verify whether the correct amount has been deducted from your account. If you see any discrepancies in the amount, inform the bank immediately.

- Always use licensed anti-virus software.

- To protect your computer from new viruses, always use licenced anti-virus software. Pirated versions of anti-virus softwares may be free, but they may fail to protect your computer from new viruses prevalent in the online world. In addition, you will get notifications for updates in the software periodically. Ensure you keep your anti-virus updated so your confidential information is always protected.

- Disconnect the internet connection when not in use

- Most broadband users do not disconnect the internet connection on their computer when they are not using it. Malicious hackers can access your computer via an internet connection and steal your confidential banking information. To protect your data, ensure that you disconnect from the internet when you do not require it.

- Type your internet banking URL

- It is safer to type your bank URL in the browser’s address bar than to click on links given in an email. There are fraudsters sending emails with fraudulent website links designed exactly like the bank’s original website. Once you enter your login details on such a website, they may be used to access your account and steal your money. While logging on, check for ‘HTTPS://’ in the URL and ensure that it is your bank’s authentic website.

Also Read, SBI Q1 Net profit of Rs 6,068 crore, misses out on estimates

Follow us or bookmark us for more Technology News Celeb Bio box office collection report celebrities trailers and promos

Join us on Facebook

Join us on Twitter