New Study Estimates as Much as $75 Billion in Global Victims’ Losses to Pig-Butchering Scam

Bollywoodfever, March 1: According to a recent study, scammers engaging in the “pig-butchering” scheme have extracted over $75 billion from victims globally, a figure significantly higher than prior estimates.

This revelation comes from research conducted by John Griffin, a finance professor at the University of Texas at Austin, and his graduate student, Kevin Mei.

They compiled cryptocurrency addresses from over 4,000 victims and utilized blockchain tracing tools to monitor the transfer of funds from these victims to the perpetrators, predominantly located in Southeast Asia.

Over a span of four years, from January 2020 to February 2024, these criminal organizations funneled more than $75 billion into cryptocurrency exchanges, as identified by Griffin, an expert on financial market fraud.

Griffin noted that while this staggering sum primarily reflects the earnings from the pig-butchering scams, it may also include money from other illicit activities.

Griffin highlighted the significant challenge posed by these sophisticated and largely unchecked criminal networks in an interview.

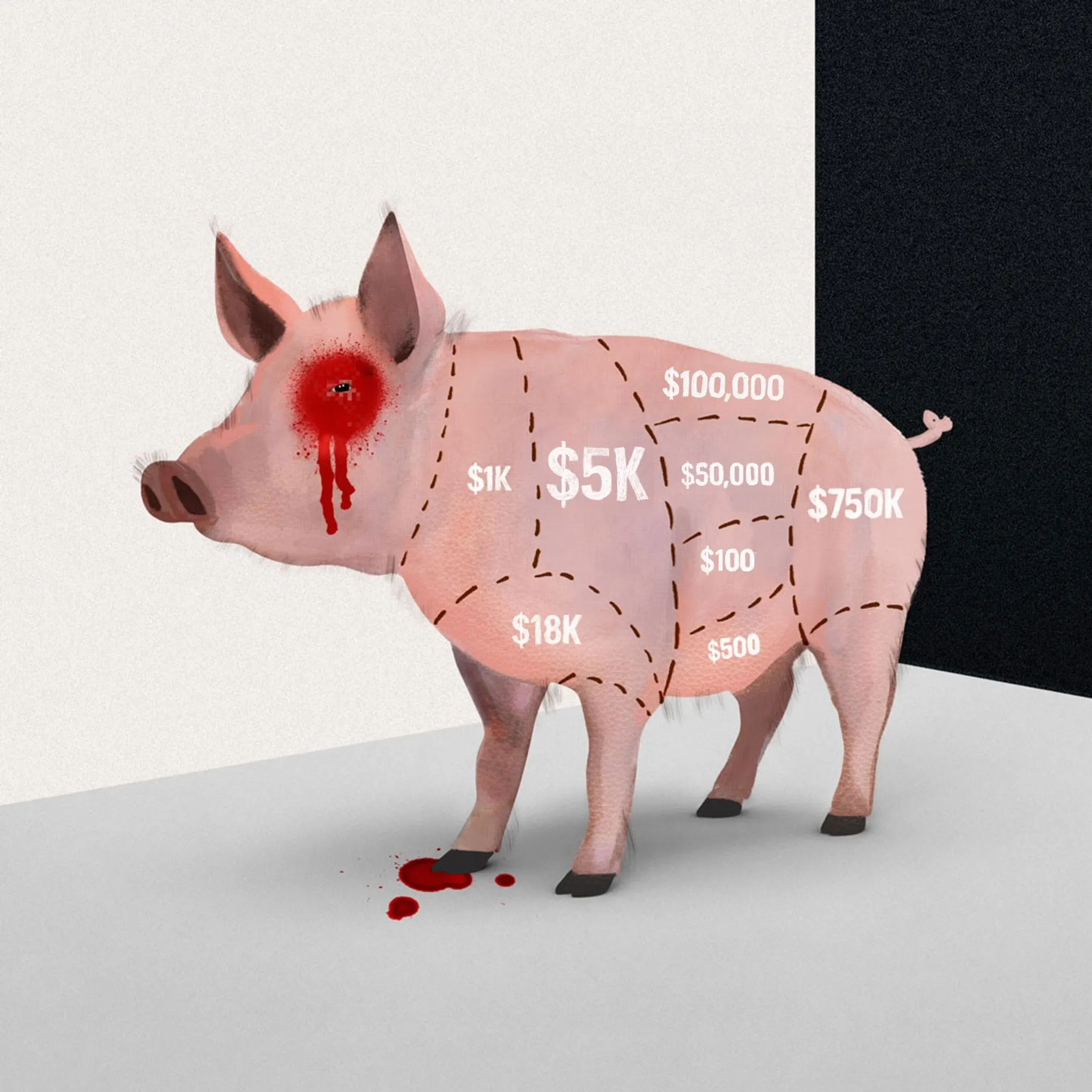

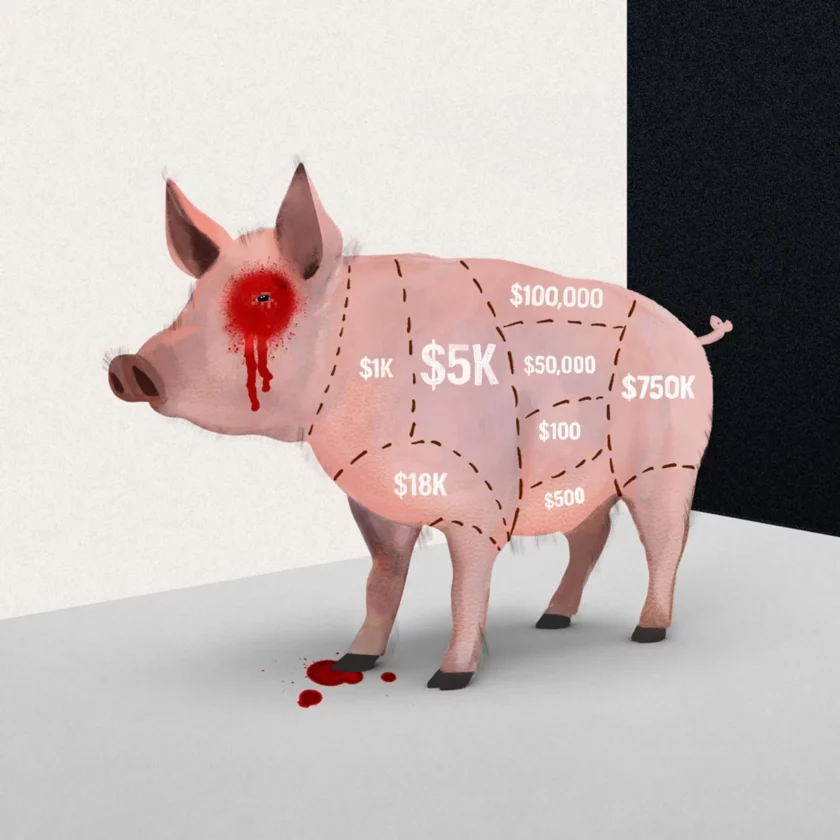

The term “pig butchering” refers to a scam reminiscent of the agricultural practice where farmers fatten up hogs before slaughtering them. This modern deceit begins with seemingly innocuous wrong-number text messages.

Individuals who engage with these texts find themselves enticed into cryptocurrency investments that, unbeknownst to them, are entirely fictitious.

Once a significant amount of money has been transferred, the scammers vanish, often leaving victims out of pocket by large sums, ranging from hundreds of thousands to millions of dollars.

A notable case involved a Kansas banker this month who was implicated in embezzling $47.1 million from his bank in connection with such a scam.

The operatives behind these messages are frequently victims of human trafficking from various parts of Southeast Asia. They are deceived by promises of lucrative employment opportunities and brought to facilities in countries like Cambodia and Myanmar, where they are coerced into executing scams under conditions that can include confinement, physical abuse, and torture.

The United Nations has reported that over 200,000 individuals are currently detained in these so-called scam compounds.

The recent study titled “How Do Crypto Flows Finance Slavery? The Economics of Pig Butchering,” released on Thursday by Griffin and Mei, highlights that $15 billion of the traced funds originated from five major exchanges, including Coinbase, which are commonly utilized by victims from Western nations.

The findings indicate that the scammers predominantly convert the collected funds into Tether, a widely used stablecoin, with 84% of the traced transaction volume involving this particular cryptocurrency.

“In the past, transferring large sums of money through the financial system was a complex task,” explained Griffin. Traditional methods required navigating bank protocols and adhering to stringent ‘know-your-customer’ rules, or resorting to physically moving cash in bags.

Paolo Ardoino, Tether’s Chief Executive Officer, contested the report’s accuracy, asserting that Tether’s operations are fully digital, traceable, and that assets can be confiscated to apprehend criminals. We collaborate with law enforcement to achieve this,” Ardoino stated.

While Tether has assisted in freezing accounts linked to fraudulent activities, the challenge remains that scammers often withdraw the funds before any action can be taken.

“Our study highlights that they preferentially use this currency for their criminal activities,” Griffin remarked.

Chainalysis Inc., a blockchain analytics company, suggested the study’s financial estimates might be overstated.

Maddie Kennedy, a representative for Chainalysis, pointed out that not all funds received by a blockchain address linked to pig-butchering scams are necessarily derived from fraudulent activities, citing the difficulty in accurately quantifying such funds due to limited reporting. Tether is among Chainalysis’s clients.

Chainbrium, a Norwegian crypto investigation firm, collected many of the blockchain addresses used by the fraud victims and conducted an analysis.

It identified that a significant portion of the illicit funds was channeled through Tokenlon, a so-called decentralized crypto exchange, which scammers utilized to disguise the origins of the money. Tokenlon has not responded to inquiries for comment.

“Money from people in the U.S. is directly funneled into the underground economy of Southeast Asia,” stated Jan Santiago, a Chainbrium consultant.

The fraud proceeds are eventually transferred to centralized crypto exchanges for conversion into conventional currencies.

According to Griffin, Binance was the preferred platform for such transactions, even after the company and its founder, Changpeng Zhao, admitted guilt to charges related to anti-money laundering and sanctions in November and agreed to a $4.3 billion settlement to conclude an extensive legal examination.

“Binance is the favored platform for moving large sums out of the system,” Griffin observed.

Similar to Tether, Binance has collaborated with law enforcement on several occasions to freeze accounts involved in fraudulent activities and facilitate the return of funds to victims.

A Binance spokesperson, Simon Matthews, highlighted the company’s ongoing efforts to work with law enforcement and regulatory bodies to increase awareness about scams, including those related to pig-butchering, noting a recent instance where $112 million was seized in connection with such a scam.

Also Read, Brian Mulroney, Ex-Prime Minister of Canada, Passes Away at Age 84

Bookmark and Follow us for More Entertainment News